Dependent Care Fsa 2024 Limit. Dependent care fsa limit 2024 income limits 2024. A dependent care fsa lets a household set aside up to $5,000 to pay child care expenses for kids under age 13.

An employee has one qualifying dependent and $5,000 in dependent care fsa expenses. Dependent care fsa limit 2024 income limits 2024.

A Dependent Is Defined As Someone Who Spends At Least 8 Hours A Day In Your Home And Is One Of The Following:

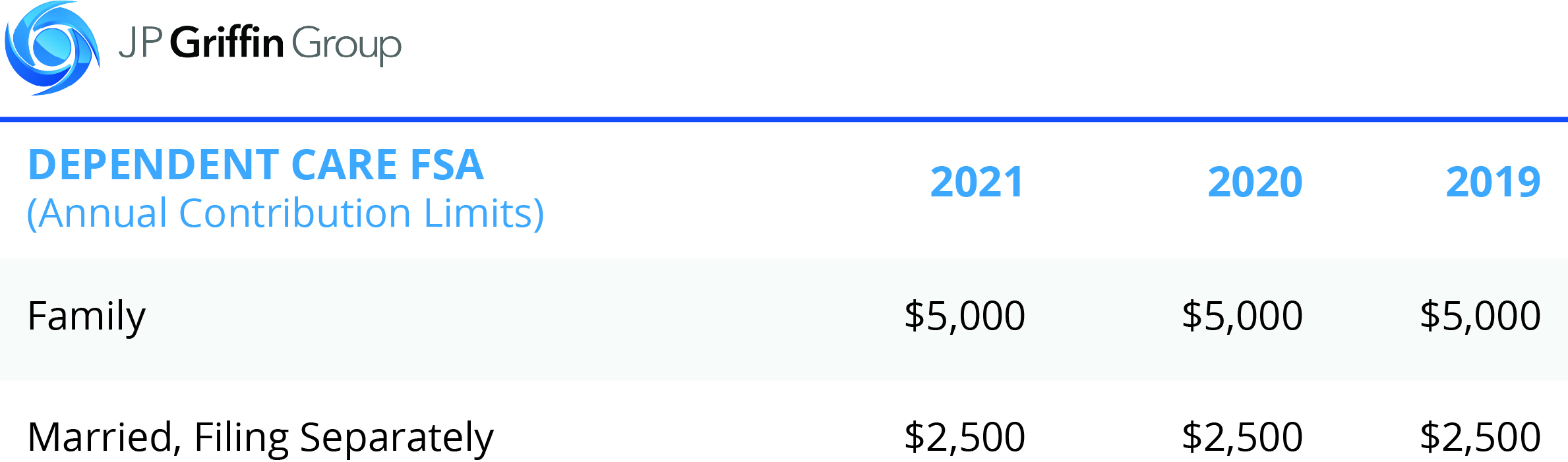

The limits for 2023 are $ 2,500 for an individual or $ 5,000 for a family, and will remain the same for the 2024 plan year.

A Dependent Care Flexible Spending Account Can Help You Save On Caregiving Expenses, But Not Everyone Is Eligible.

What is the dependent care fsa limit for 2024?

Dependent Care Fsa 2024 Limit Images References :

Source: velmaqshelagh.pages.dev

Source: velmaqshelagh.pages.dev

Irs Fsa Max 2024 Joan Ronica, Join our short webinar to discover what kind of. A dependent is defined as someone who spends at least 8 hours a day in your home and is one of the following:

Source: adrianqanastasia.pages.dev

Source: adrianqanastasia.pages.dev

Dependent Care Fsa Limit 2024 Limit Over 65 Tresa Harriott, The 2024 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households. The dependent care fsa limit for 2024 is $10,500 for married couples filing jointly and $5,250 for individuals or married couples filing separately.

Source: kelleywdeonne.pages.dev

Source: kelleywdeonne.pages.dev

Irs Dependent Care Fsa Limits 2024 Nissa Leland, What are the 2024 allowable amounts for the dependent care assistance program (dcap)? $5000 is the annual limit.

Source: kelleywdeonne.pages.dev

Source: kelleywdeonne.pages.dev

Irs Dependent Care Fsa Limits 2024 Nissa Leland, To calculate the possibility of a tax credit, subtract $5,000 from the. Here's a breakdown of dcfsa contribution limits:

Source: joanneswdarb.pages.dev

Source: joanneswdarb.pages.dev

Irs Dependent Care Fsa 2024 Jayme Loralie, Find out if this type of fsa is right for you. If you exclude or deduct dependent care benefits provided by a dependent care benefit plan, the total amount you exclude or deduct must be less than the dollar limit for.

Source: dottieqsharyl.pages.dev

Source: dottieqsharyl.pages.dev

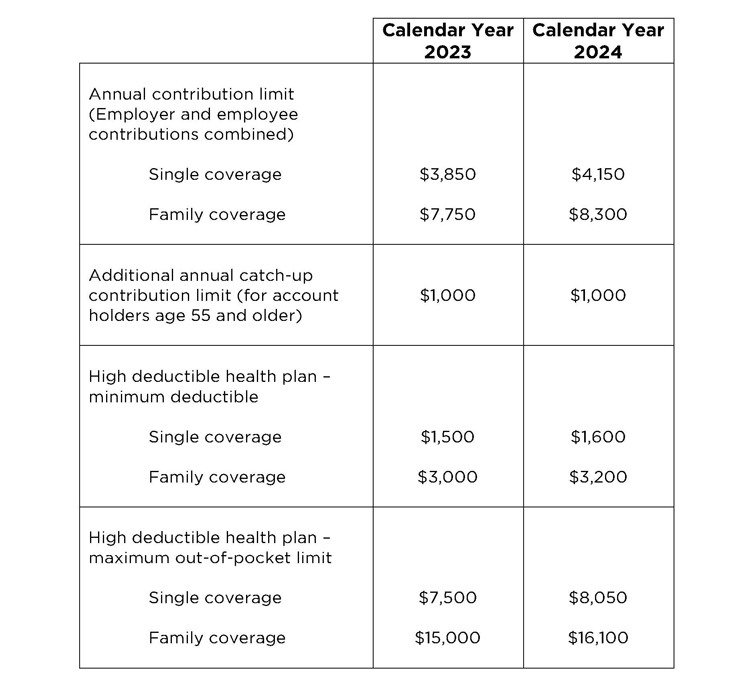

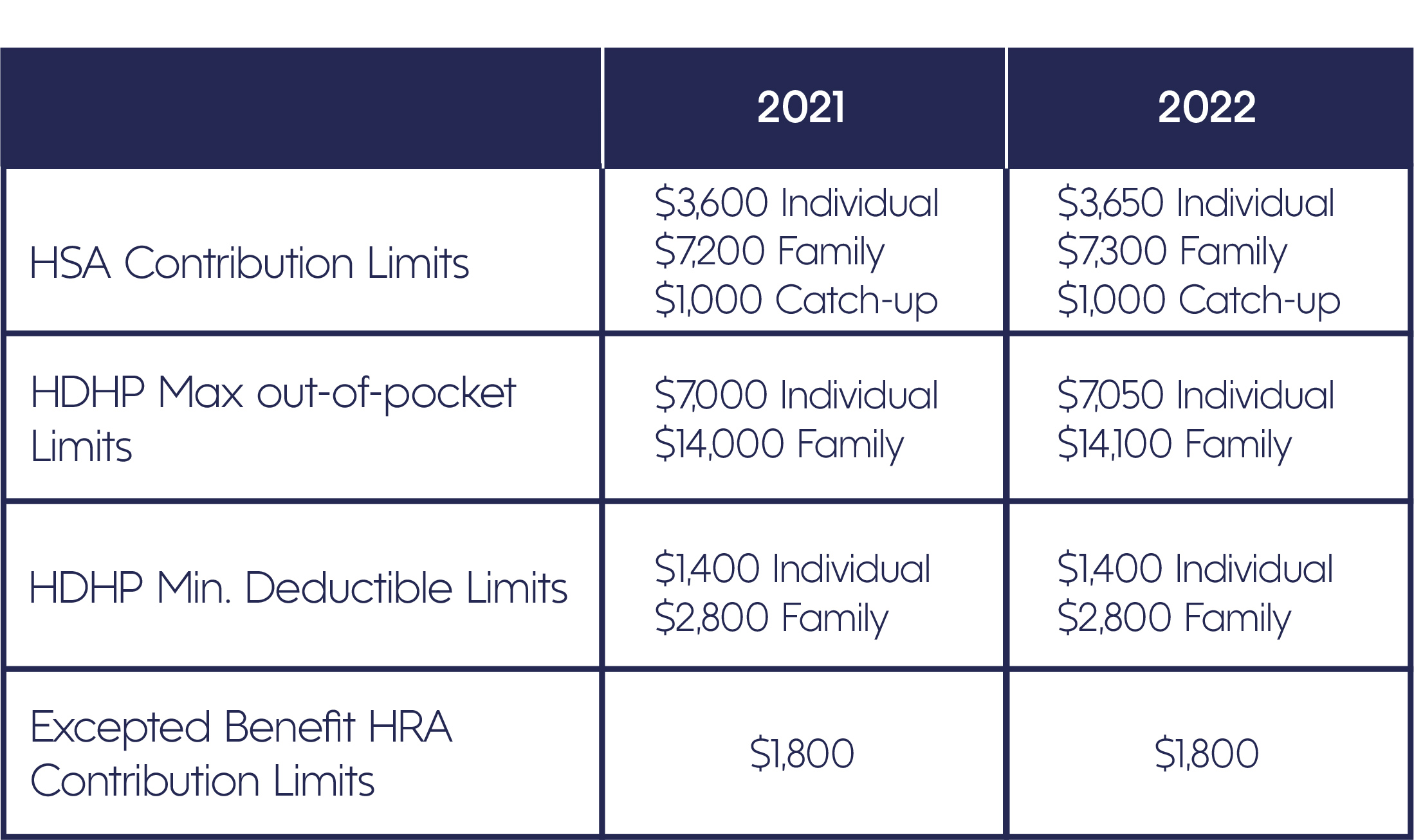

Dependent Care Fsa Contribution Limits 2024 Over 65 Ivory Letitia, You can contribute up to $5,000 in 2024 if you’re married and file jointly with your spouse, or if you’re a single caretaker for a dependent. The irs released 2024 contribution limits for medical flexible spending accounts (medical.

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg) Source: michelinawsusy.pages.dev

Source: michelinawsusy.pages.dev

Fsa Mileage 2024 Kelsi Melitta, Internal revenue code §129 sets the annual dependent care fsa contribution limit at $5,000 (or $2,500 for married individuals filing separately). Join our short webinar to discover what kind of.

Source: ethylbshelby.pages.dev

Source: ethylbshelby.pages.dev

Dependent Care Fsa Contribution Limit 2024 Over 50 Tatum Gabriela, Amounts contributed are not subject to federal income tax, social security tax or medicare tax. Internal revenue code §129 sets the annual dependent care fsa contribution limit at $5,000 (or $2,500 for married individuals filing separately).

Source: www.youtube.com

Source: www.youtube.com

Dependent Care FSA YouTube, The dependent care fsa limit for 2024 is $10,500 for married couples filing jointly and $5,250 for individuals or married couples filing separately. But if you have an fsa in 2024, here are the maximum amounts.

Source: www.fishbowlapp.com

Source: www.fishbowlapp.com

New parent here. What is the dependent care FSA e… Fishbowl, What is the dependent care fsa limit for 2024. A dependent is defined as someone who spends at least 8 hours a day in your home and is one of the following:

$5000 Is The Annual Limit.

Internal revenue code §129 sets the annual dependent care fsa contribution limit at $5,000 (or $2,500 for married individuals filing separately).

It Remains At $5,000 Per Household Or $2,500 If Married, Filing Separately.

What is the dependent care fsa limit for 2024?

2024